Some company will provide transport allowances and better still petrol card thrown in also. Any help would be much appreciated.

2019 Mazda Cx 5 Prices Announced By Bermaz Starts From Rm137k Autoworld Com My

This includes private use travel.

. 4 July 2019 Information has been updated to include tax years 2018 to 2019 and 2019 to 2020 also removed some older details. HR for Beginner in Mandarin 人事基础班 5 July2022 900 AM 500 PM. However depending on the type of allowance some LHDN tax deductions are applicable and you can meet both top-management and employees expectations.

In this article Seekers will share. Select your mileage preference Mileage Preference 01 cents per km 015 cents per km 02 cents per km 025 cents per km 03 cents per km 035 cents per km 04 cents per km 045 cents per km 05 cents per km 055 cents per km 06 cents per km 065 cents per km 07 cents per km 075 cents per km 08 cents per km 085 cents per km 09 cents per km 095 cents per km 1 per km. The most recent rate was set at 73ckm for petrol diesel vehicles with slightly different rates for hybrids and electric vehicles.

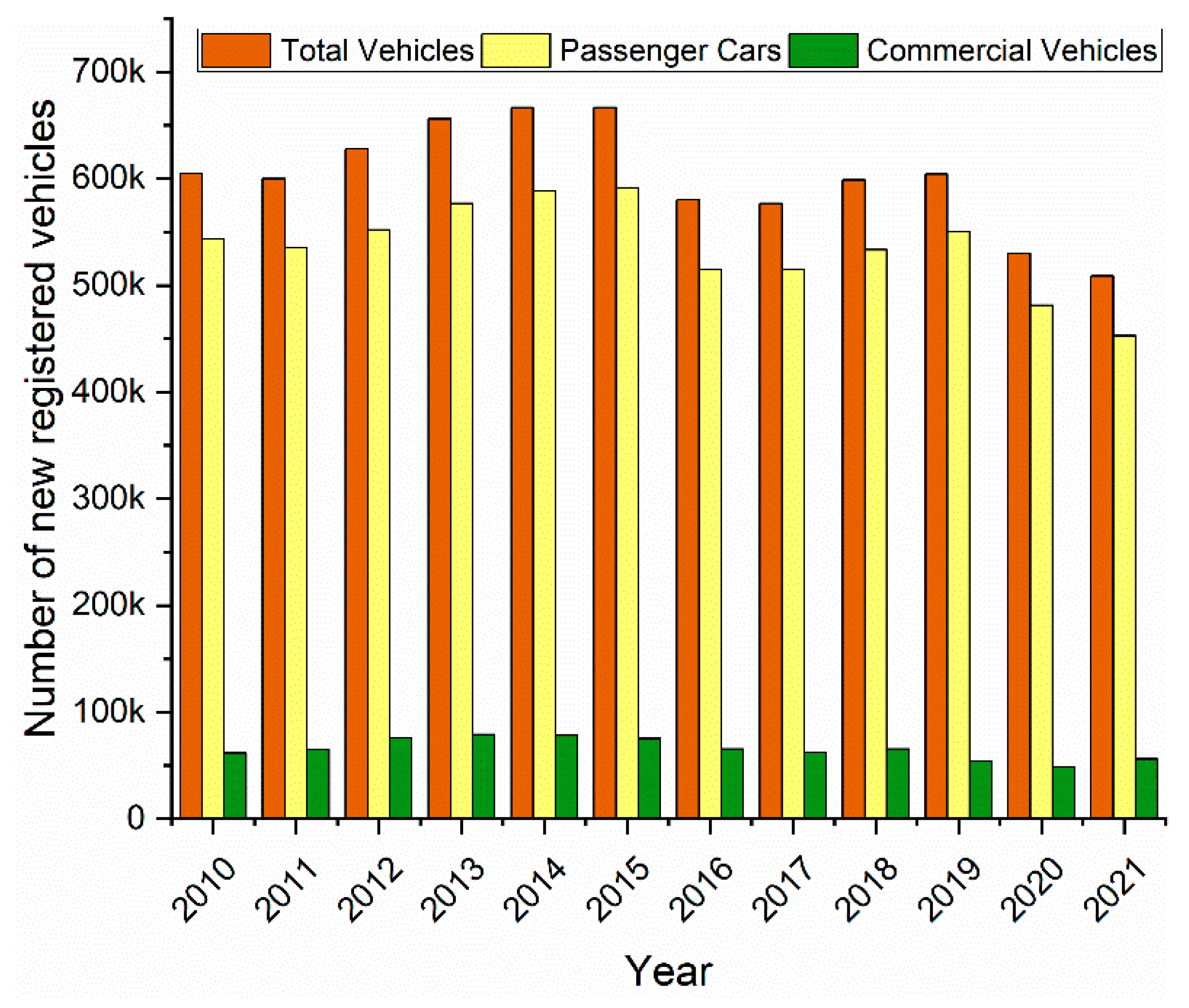

Showed that employed persons in Malaysia increased 22 per cent to 1525 million persons in the fourth quarter of 2019. 37 x GDE 045 per km x private mileage if employee pays for the cost of petrol. The claim ratio of the motor insurance sector in Malaysia decreased from 701 percent in 2019 to 625 percent in 2020.

Cents Per Kilometre Car Expenses. 20182019 Malaysian Tax Booklet 22 Rates of tax 1. Wonder if you guys travel for for company business by own car Do you claim mileage.

2021 irs standard mileage rate. April 5 2011. The IRS mileage reimbursement rate is 0575 in 2020.

Use the Tier 1 rate for the business portion of the first 14000 kilometres travelled by the vehicle in a year. It also presents details like the name and address of the physician date claimants starting and ending destination address and round trip miles. RM208 RM0 RM257 RM004 RM218 RM0 July 6 July 12 2019.

RM208 RM0 RM253 RM004 RM218 RM0 June 29 July 5 2019. My question is. Note that mileage claim is not just for the petrol that you pump but also include the maintainence of your car after travelling for high number of mileage.

The rate for 2020-21 and 2021-22 is 72 cents per km for up to 5000 business kms. The range like some bros mentioned is between 040 to 080. Let say RM200 per service then per km you need to add additional 4 cents.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess. Car needs to be send for service every 5000km3 months whichever comes first. The unemployment rate in this quarter decreased to 32 per cent the lowest unemployment rate.

Use the Tier 2 rate for the business portion of any travel over 14000 kilometres. Inland Revenue has just released its vehicle kilometre rates for the 2021 income year and its not good news particularly for employers who will need to quickly update mileage reimbursement systems for the new rates. For business use of a car van pickup truck or panel truck the rate for 2021 will be 56 cents per mile after decreasing to 575 cents per mile in 2020 down from 58 cents per mile in 2019.

RM208 RM0 RM267 RM010 RM218 RM0 July 13 July 19 2019. August 3 August 9 2019. D the amount payable on renewal of COE for the continued use of the car after the end of the 10th year.

Cents Per Km is one of the methods you can choose to satisfy the substantiation rules for individuals claiming car expenses as a tax deduction. When we talk about allowances the top-management side may consider it as an additional payout on top of the regular salary wages. This mileage reimbursement form presents the claim number employee and employer names and date of the accident.

The Tier 1 rate is a combination of your vehicles fixed and running costs. Overall year 2019 Malaysias economy registered a growth of 43 per cent 2018. Beginning on january 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be taxpayers also cannot claim a deduction for moving.

RM208 RM0 RM256 -RM011 RM218 RM0 July 20 July 26 2019. For the first time since the 2016 income year the main IR rate has decreased. The per kilometre car expense claim rate for 2022-23 is 78 cents per km.

Gsa is updating the mileage reimbursement rate for privately owned automobiles poa airplanes and motorcycles as required by statute. Taxpayers can use the optional standard mileage rates to calculate the deductible costs of. And what is the rate.

The Tier 2 rate is for running costs only. Inland Revenue has also accepted the use of this mileage rate as a reasonable estimate of costs for employers to use for the purposes of reimbursing employees for using their private vehicle for employment related use. 1000000 237650 28 A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a.

What is a fair mileage rate per km for sales staff given the size of my company. If employer pays for the cost of petrol use the rate of 055 per km instead of 045 per km. 31st July 2013 From Malaysia Kuala Lumpur.

Maintenance service wear tear Including major service say 20k KM cost divide back to RMKM. I hear something as ridiculous as RM020km this one based on current fuel price just enough to cover petrol only while i am claiming Rm080km. Minimum wages in malaysia remained unchanged at 1200 myrmonth in 2021 from 1200 myrmonth in 2020.

The rates are as follows. Employer Mar 15 2021. RM208 RM0 RM254 -RM002 RM218 RM0 July 27 August 2 2019.

47 with a value of RM142 trillion at. Rates for fuel charges have been updated for 2021 to 2022. On 442011 at 1032 PM Quantum said.

The updated Malaysian Code on Corporate Governance MCCG 2021 5 July 2022 07. We cant offer too high because we are small but i do want to be fair to my sales staff. In that year the.

Initial Ergonomics Risk Assessment - Ergonomics Trained Person ETP Training Program 5-6 July 2022. Beginning january 1 2021 the irs standard mileage rate for personal car use will be 56 cents per mile for business use a decrease of 15 cents 16 cents per mile for medical and moving mileage a decrease of 1 cent and 14 cents per mile for. While this rate is useful for tax purposes use a fixed and variable rate FAVR program to determine a.

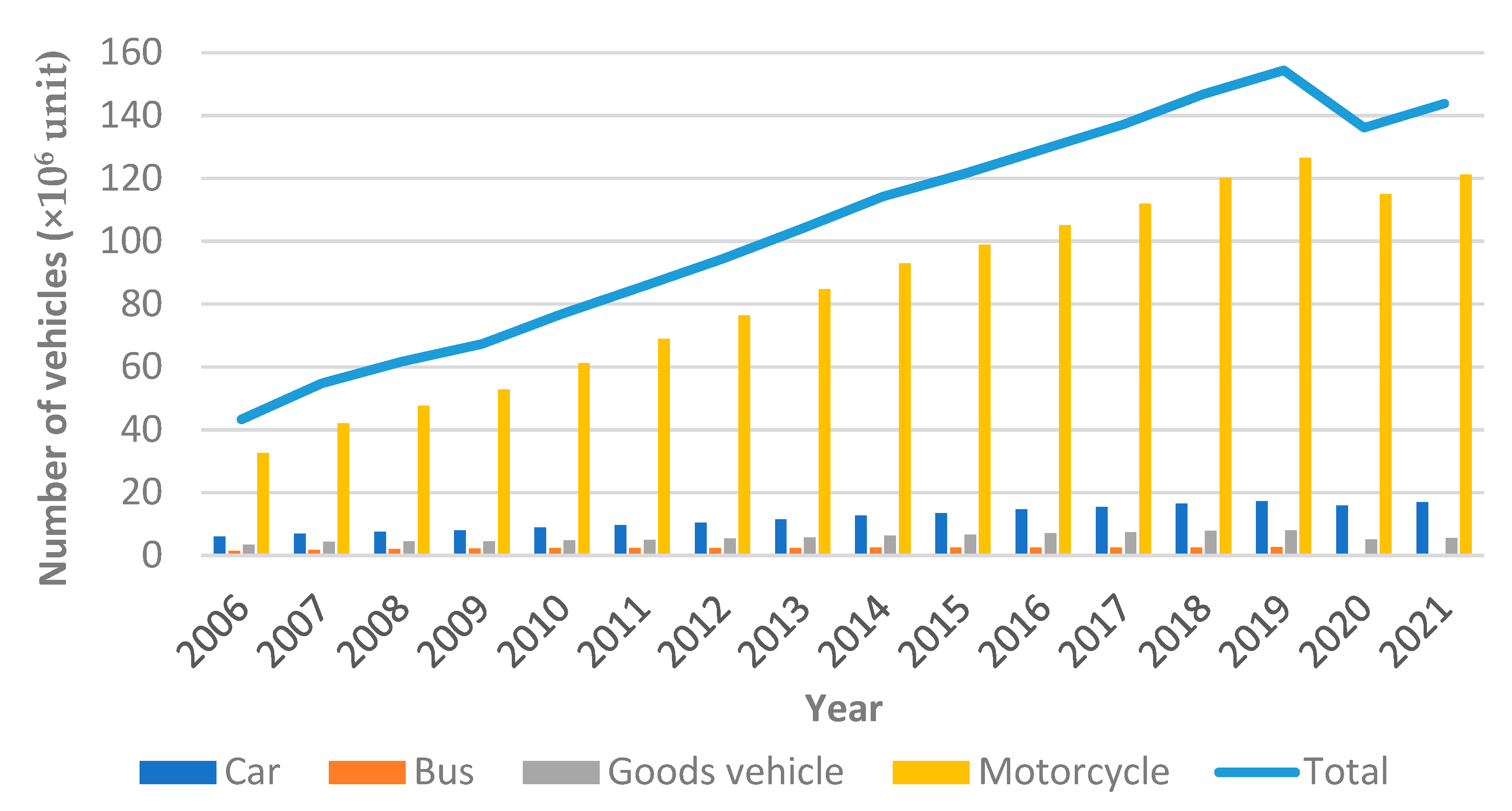

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Malaysian Monthly Household Expenditure Increased In 2019 Compared To 2016

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

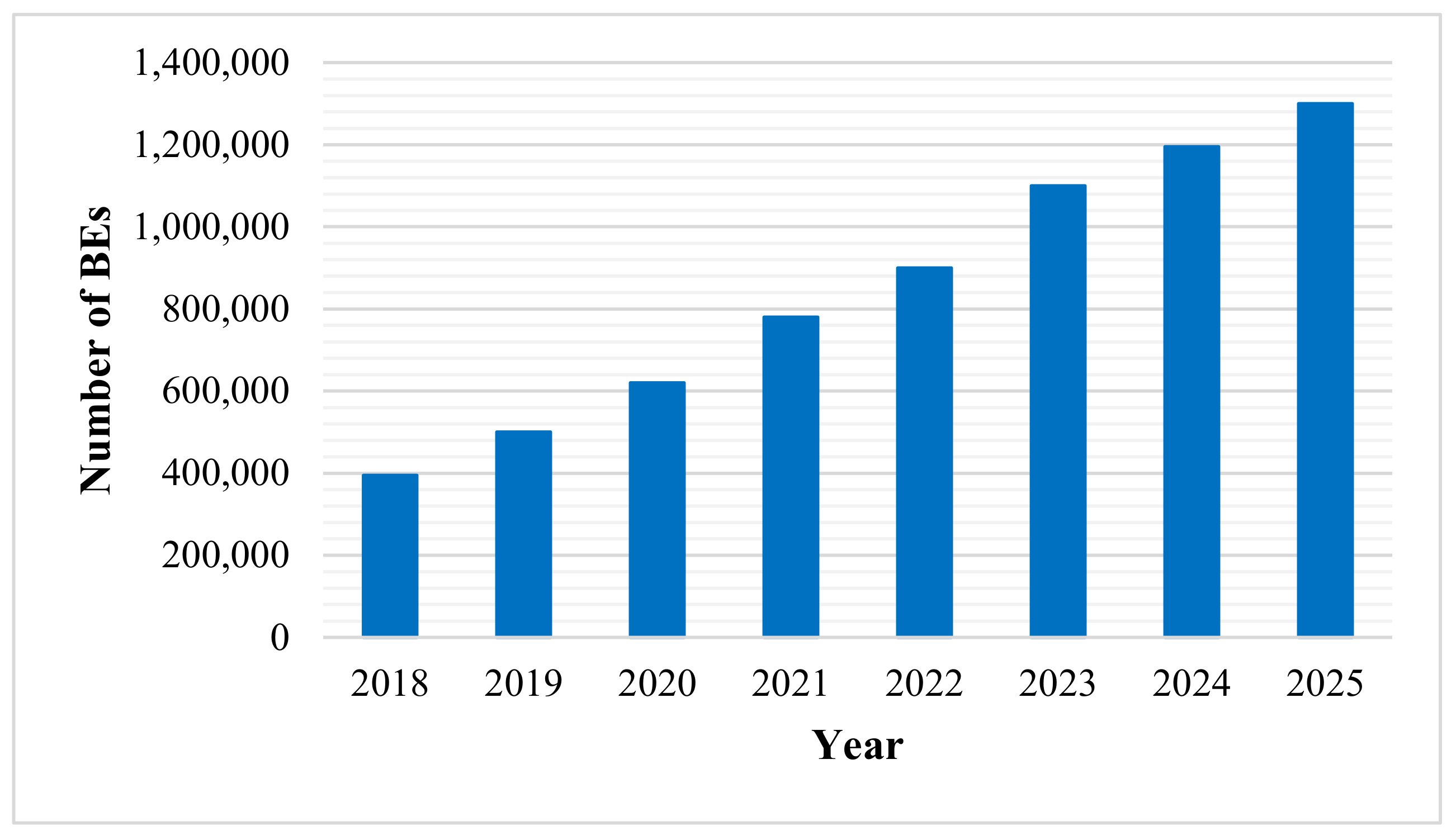

Sustainability Free Full Text Electric Buses In Malaysia Policies Innovations Technologies And Life Cycle Evaluations Html

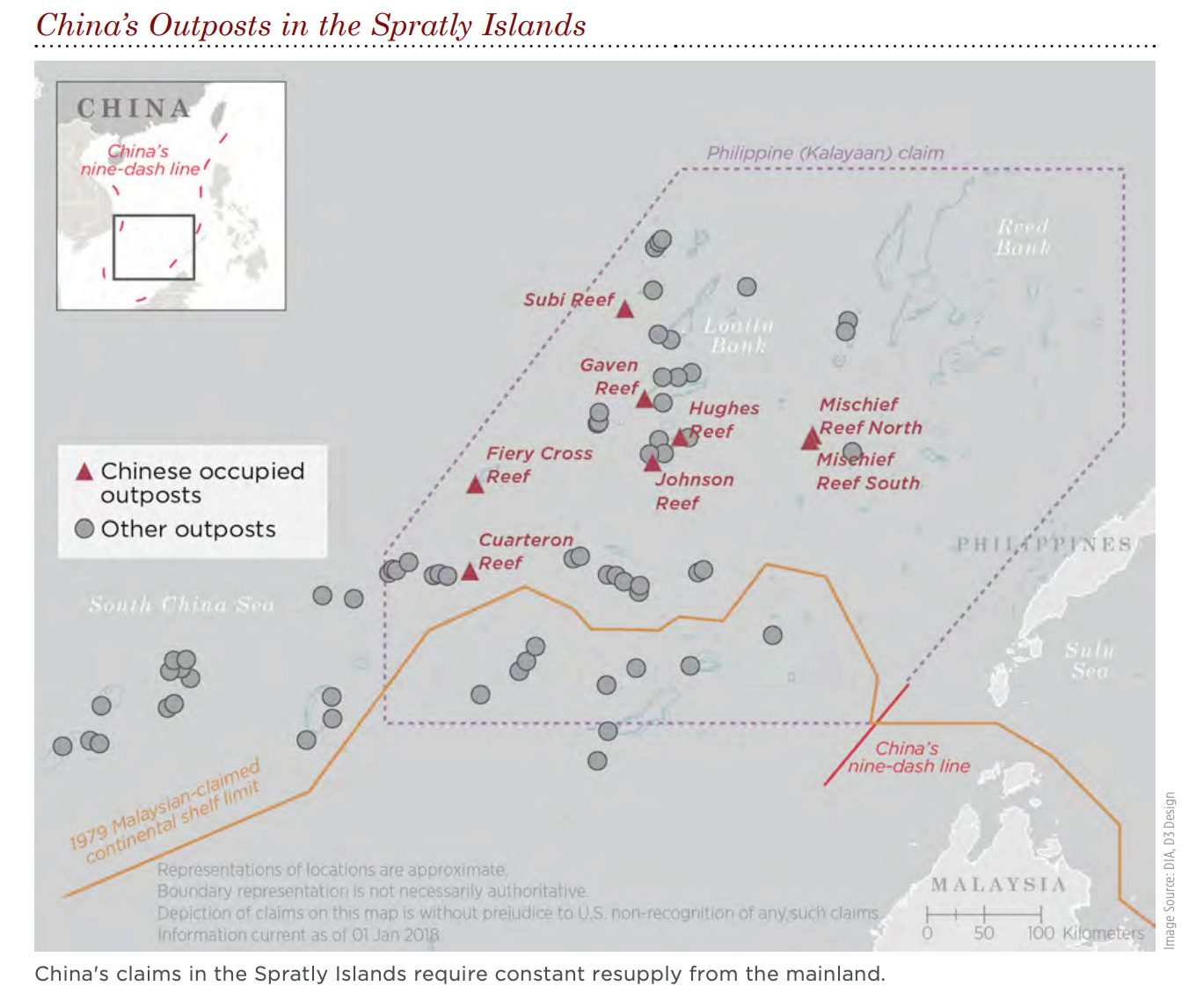

Why China Sunk A Vietnamese Fishing Boat During The Covid 19 Pandemic

New 2022 Irs Standard Mileage Rates

Mileage Reimbursements Revisited Again September 2019 Tax Alert Deloitte New Zealand

Sustainability Free Full Text Electric Buses In Malaysia Policies Innovations Technologies And Life Cycle Evaluations Html

Standard Operating Procedures Mga

Pdf Fitness To Practise For Doctors And Medical Students With Mental Issues In Malaysia

Pdf Dynamic Relationship Between Corporate Board Structure And Firm Performance Evidence From Malaysia

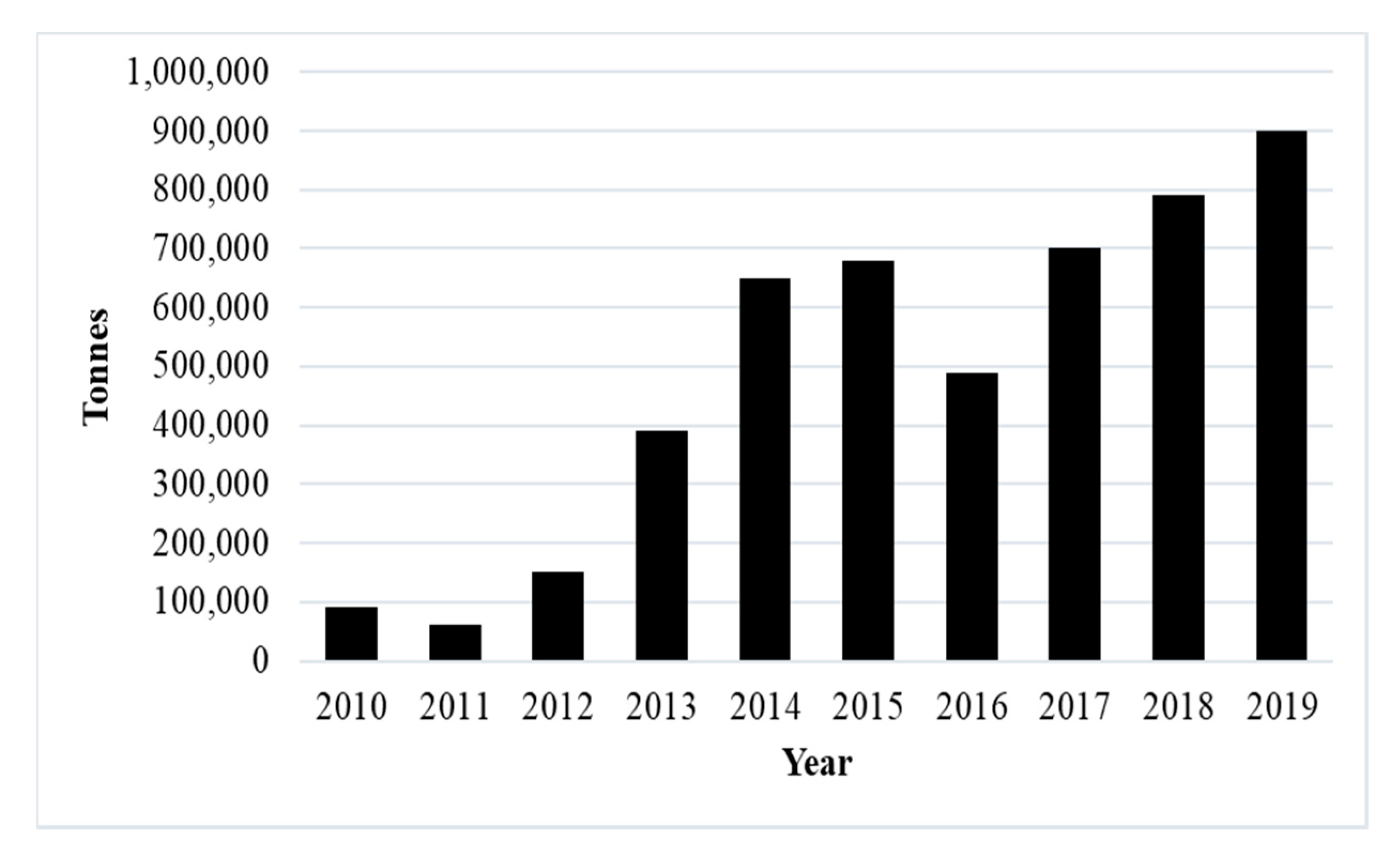

Processes Free Full Text The Challenges Of A Biodiesel Implementation Program In Malaysia Html

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Korean Air Named World S 9th Most Punctual Airline Korean Air

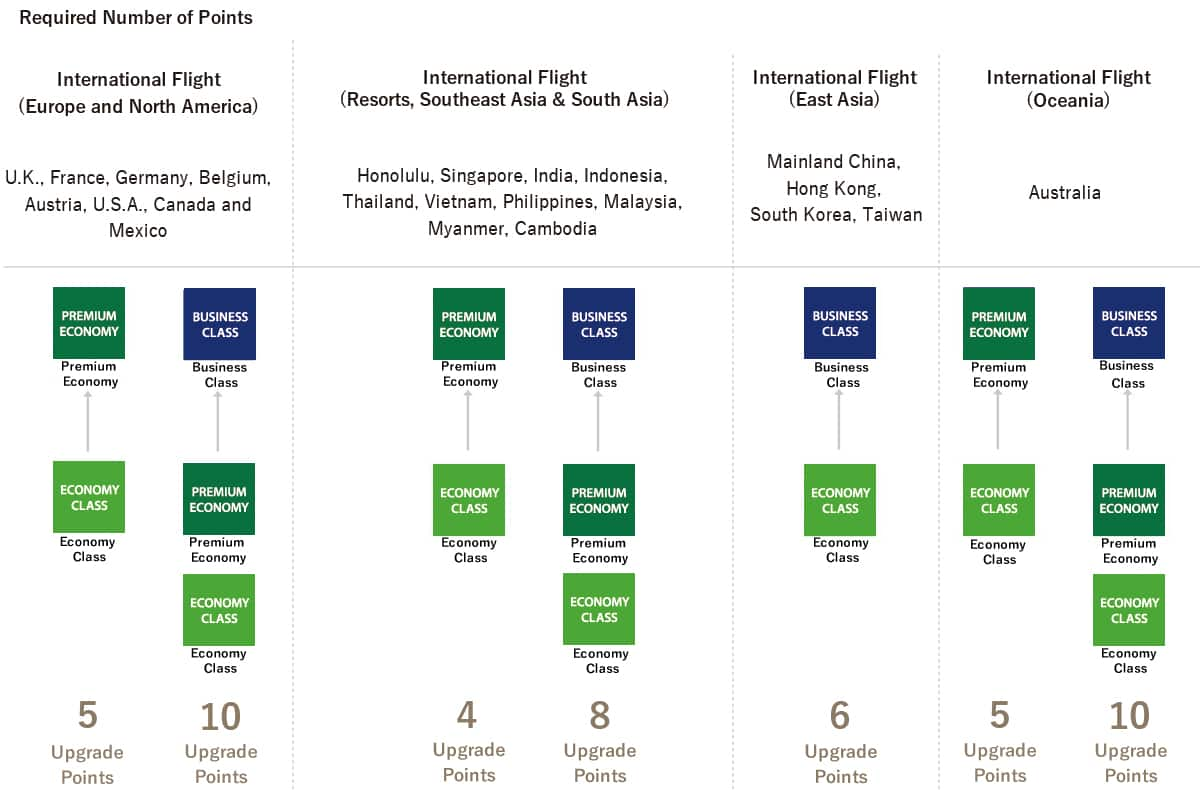

Ana International Upgrade Awards Premium Economy Upgrade Awards Will Become Available For Flights From April 1 2020 Ana Mileage Club

Malaysia Airlines Flight Mh370 Where Is It The Atlantic